- News

- Business

The OECD said growth will slow to 1.2% next year, before edging up to 1.3% in 2027, with ‘substantial’ downside risks from fiscal tightening.

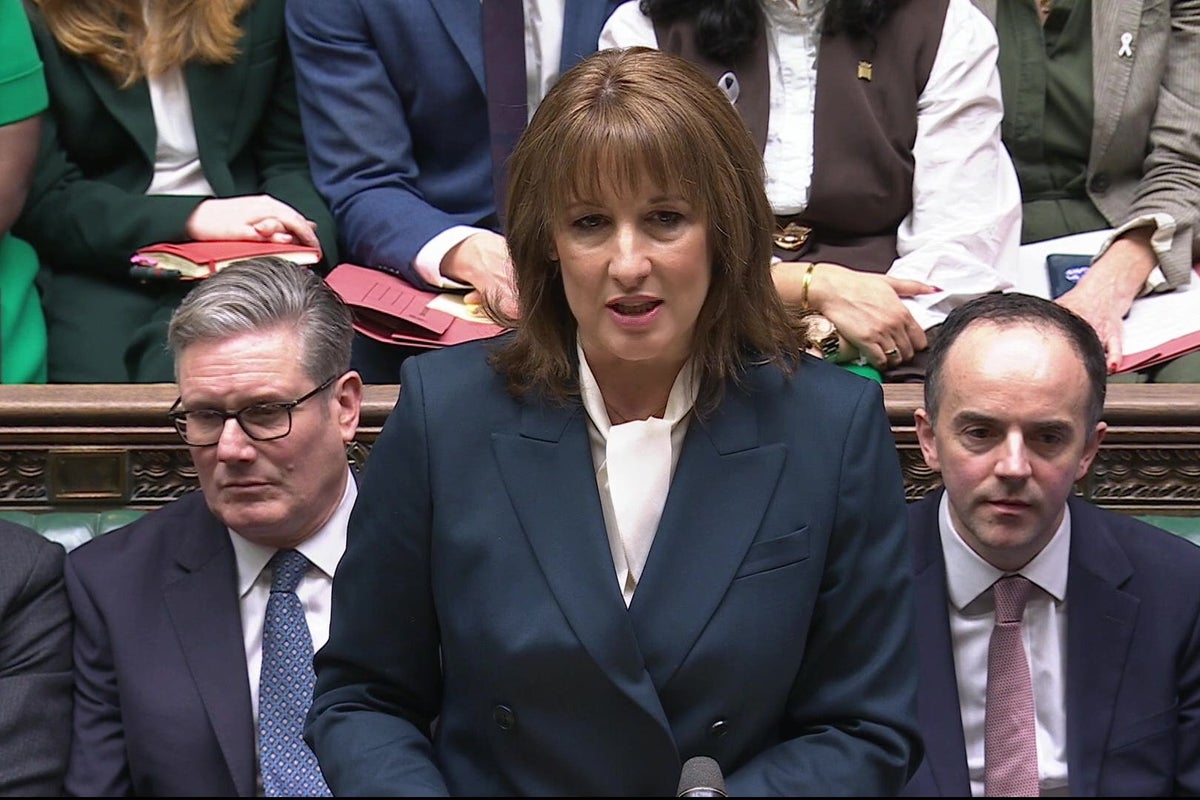

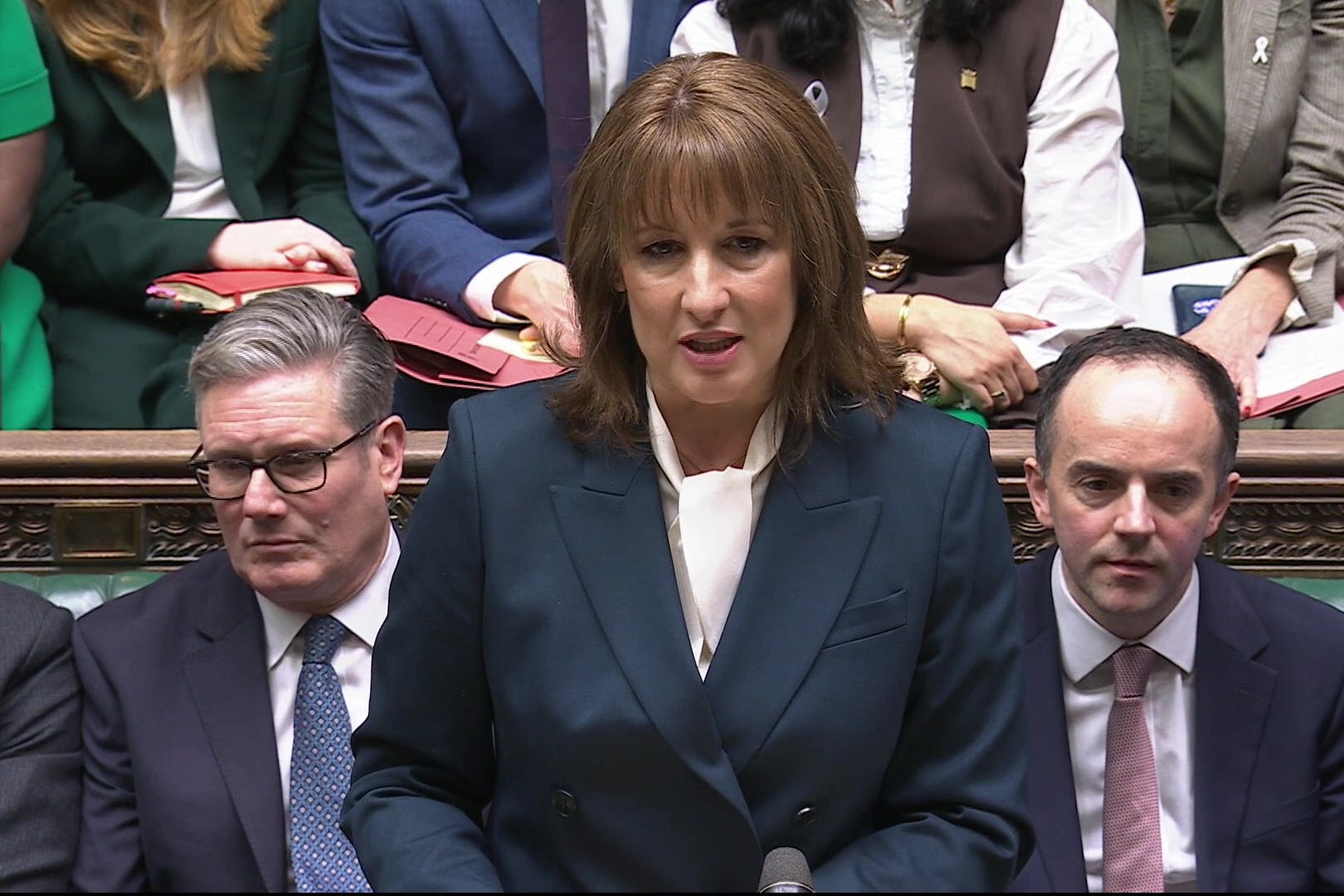

Holly WilliamsTuesday 02 December 2025 10:42 GMT open image in galleryTax hikes and spending cuts will put pressure on the UK economy over the next two years and inflation will remain among the highest in the among the G7 economies, according to a new report. (PA) (PA Wire)

open image in galleryTax hikes and spending cuts will put pressure on the UK economy over the next two years and inflation will remain among the highest in the among the G7 economies, according to a new report. (PA) (PA Wire)

For free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails

Sign up to our free breaking news emails

Sign up to our free breaking news emails

Email*SIGN UP

Email*SIGN UPI would like to be emailed about offers, events and updates from The Independent. Read our Privacy notice

Tax hikes and spending cuts will put pressure on the UK economy over the next two years – and inflation will remain among the highest in the among the G7 economies, according to a new report.

The Organisation of Economic Co-operation and Development (OECD) said the Government’s ongoing fiscal consolidation – meaning higher taxes and reduced government spending – will act as a “headwind” to the UK economy, with “past tax and spending adjustments weighing on household disposable income and slowing consumption”.

In its latest economic outlook, the influential organisation said UK growth will slow from 1.4% this year to 1.2% next year, before edging up to 1.3% in 2027, with “substantial” downside risks of the fiscal tightening plans.

It kept its forecast unchanged for 2025, but upgraded the prediction for 2026 from the 1% pencilled in three months ago.

The report comes amid mounting pressure on Chancellor Rachel Reeves over last week’s Budget, with accusations that she misled voters over the state of the public finances ahead of the event, while businesses have criticised it for failing to include measures to boost growth.

The Chancellor announced £26 billion worth of tax rises at the November 26 budget, with measures including a freeze on income tax thresholds which will leave 1.7 million people paying more, taking the tax burden to an all-time high, according to the Office for Budget Responsibility (OBR).

The OBR also last week downgraded its growth forecasts for each of the next four years in a damning verdict on the impact of budget measures on the wider economy.

In another challenge facing the UK economy, the OECD said inflation in Britain will be highest of all the G7 advanced economies this year, at 3.5%, and will remain second highest in 2026 at 2.5%, behind only the United States, despite being lower than the 2.7% it previously forecast.

Inflation will fall back to 2.1% in 2027, close to the Bank of England’s 2% target – though it will still remain the third highest in the G7.

The OECD said fiscal tightening would help improve the Government’s deficit “substantially” as total revenue is set to reach 40% of gross domestic product (GDP), though it stressed the timing of measures would be key.

It warned: “Continuing to ensure that consolidation is carefully timed, given substantial downside risks to growth and upside risks to inflation, and well-calibrated, with a combination of revenue raising measures and spending cuts, is essential.

“Tax and spending measures should also aim to further support growth potential, complementing ongoing structural reforms such as the overhaul of infrastructure planning and the simplification of financial services regulation.”

The report predicts there will be two more cuts in interest rates, from 4% currently to 3.5% in the second quarter of 2026, but that this will mark the end of rate reductions.

Lower borrowing costs, together with an improvement in global trade growth, will provide “moderate tailwinds from the second half of 2026, with investment and exports supporting the economy”, it said.

However, the OECD also cautioned there was a risk rates could stay higher for longer if inflation remains stubborn, given the ongoing high cost of food and the impact of April’s increase in payroll tax, which is seeing firms hike prices in the face of higher wage bills.

In response, Ms Reeves said: “Last week, my Budget cut waiting lists, cut borrowing and debt, and cut the cost of living.

“Less than a week later, the OECD has upgraded our growth and cut its forecast for inflation next year.

“The choices that I made at the Budget are expected to cut inflation by 0.4 percentage points, helping cut the cost of living for households and costs for our businesses.”

Shadow chancellor Sir Mel Stride said: “Rachel Reeves promised growth but growth is expected to weaken next year, because of her choices. This is the cost of policies that punish work, businesses and investment.”

The OECD kept its forecasts unchanged for the global economy this year and next, predicting worldwide GDP will slow from 3.2% in 2025 to 2.9% in 2026, before picking up again to 3.1% in 2027.

“The global economy has proved more resilient than expected this year, but underlying fragilities remain,” the OECD said.

“The full effects of higher tariffs have yet to be felt, but are becoming increasingly visible in spending choices, business costs and consumer prices, especially in the US.”