- StockStory Top Pick NVDA +1.37%

- GC=F -0.36% TSLA +1.71%

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On Monday, Chinese President Xi Jinping highlighted the ongoing progress in U.S.-China trade ties after a phone call with President Donald Trump. This comes after it was reported that Washington is considering allowing Nvidia Corp (NASDAQ:NVDA) to resume AI chip sales to China.

Xi Jinping Highlights Positive Trade Momentum

During Monday's call, Xi told Trump that US-China trade relations have maintained a positive momentum and stressed that both nations should expand their list of cooperation, according to China's Ministry of Foreign Affairs.

The phone call, not previously disclosed, follows a framework agreement reached by the two leaders in South Korea in October, aiming to ease lingering trade tensions.

Don’t Miss: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Trump Praises Relationship And Trade Progress

Taking to Truth Social, Trump described the call as "very good" and said it covered a wide range of topics, including Ukraine/Russia, fentanyl and U.S. farm products such as soybeans.

He highlighted that the conversation was a follow-up to the South Korea meeting, adding, "Our relationship with China is extremely strong! ... We agreed that it is important that we communicate often, which I look forward to doing."

Trump also said that he would visit Beijing in April at Xi's invitation and had extended an invitation to Xi for a U.S. state visit later this year.

Source: Truth Social

See Also: Missed Nvidia and Tesla? RAD Intel Could Be the Next AI Powerhouse — Invest Now at Just $0.85 a Share

The South Korea framework, agreed on Oct. 30, included Washington's commitment to avoid imposing 100% tariffs on Chinese imports and Beijing's promise to hold off on export licensing restrictions for crucial rare earth minerals.

Nvidia Could Reenter The Chinese Market

This came after it was reported that the Trump administration is considering allowing Nvidia to resume sales of its high-end H200 AI chips to China.

The Commerce Department is reviewing previous restrictions that blocked these exports due to national security concerns.

Nvidia CEO Jensen Huang previously said the company's China business had collapsed, with its market share plunging from 95% to zero under the export bans, calling the situation not ideal for anyone.

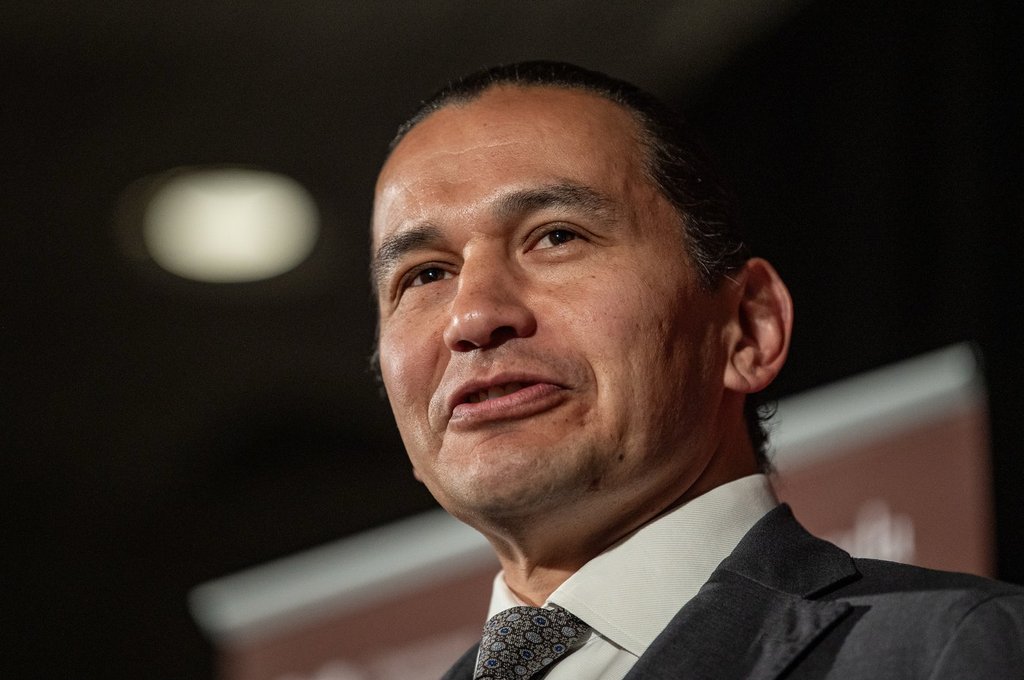

Photo Courtesy: Alessia Pierdomenico on Shutterstock.com

Trending Now:

-

Wall Street's $12B Real Estate Manager Is Opening Its Doors to Individual Investors — Without the Crowdfunding Middlemen

-

Deloitte's #1 Fastest-Growing Software Company Lets Users Earn Money Just by Scrolling — Accredited Investors Can Still Get In at $0.50/Share.

Building Wealth Across More Than Just the Market

Building a resilient portfolio means thinking beyond a single asset or market trend. Economic cycles shift, sectors rise and fall, and no one investment performs well in every environment. That's why many investors look to diversify with platforms that provide access to real estate, fixed-income opportunities, professional financial guidance, precious metals, and even self-directed retirement accounts. By spreading exposure across multiple asset classes, it becomes easier to manage risk, capture steady returns, and create long-term wealth that isn't tied to the fortunes of just one company or industry.

Arrived

Backed by Jeff Bezos, Arrived Homes makes real estate investing accessible with a low barrier to entry. Investors can buy fractional shares of single-family rentals and vacation homes starting with as little as $100. This allows everyday investors to diversify into real estate, collect rental income, and build long-term wealth without needing to manage properties directly.

Worthy Bonds

For those seeking fixed-income style returns without Wall Street complexity, Worthy Property Bonds offers SEC-qualified, interest-bearing bonds starting at just $10. Investors earn a fixed 7% annual return, with funds deployed to small U.S. businesses. The bonds are fully liquid, meaning you can cash out anytime, making them attractive for conservative investors looking for steady, passive income.

IRA Financial

Self-directed investors looking to take greater control of their retirement savings may consider IRA Financial. The platform enables you to use a self-directed IRA or Solo 401(k) to invest in alternative assets such as real estate, private equity, or even crypto. This flexibility empowers retirement savers to go beyond traditional stocks and bonds, building diversified portfolios that align with their long-term wealth strategies.

Moomoo Idle Cash

Moomoo isn't just for trading — it's also one of the most attractive places to park cash. New users can earn a promotional 8.1% APY on uninvested cash, combining a 3.85% base rate with a 4.25% booster once activated. On top of that, eligible new users can also score up to $1,000 in free Nvidia stock—but the real draw here is the ability to earn bank-beating interest rates without having to move into riskier assets.

American Hartford Gold

For investors concerned about inflation or seeking portfolio protection, American Hartford Gold provides a simple way to buy and hold physical gold and silver within an IRA or direct delivery. With a minimum investment of $10,000, the platform caters to those looking to preserve wealth through precious metals while maintaining the option to diversify retirement accounts. It's a favored choice for conservative investors who want tangible assets that historically hold value during uncertain markets.

This article Xi Jinping Says US-China Trade Relations Maintain Positive Momentum As Trump Considers Allowing Nvidia AI Chip Sales To Beijing originally appeared on Benzinga.com

Terms and Privacy Policy Privacy Dashboard More Info